Introduction

Stepping into the world of investing can feel overwhelming, especially with the endless options available. As a beginner, the key to financial success is not in chasing high returns but in understanding risk, consistency, and starting early. The year 2025 presents several accessible, beginner-friendly investment opportunities that are safe, offer reasonable returns, and help you build wealth over time.

In this blog post, we’ll explore the top 5 best investment options in India for beginners in 2025—tailored for safety, simplicity, and long-term financial growth.

1. Public Provident Fund (PPF)

The Public Provident Fund is one of the most popular investment instruments backed by the Government of India. It’s safe, tax-free, and ideal for long-term wealth creation.

Key Features:

- Interest Rate: ~7.1% p.a. (revised quarterly)

- Lock-in Period: 15 years

- Minimum Investment: ₹500/year

- Maximum Investment: ₹1.5 lakh/year

- Tax Benefit: Deduction under Section 80C

Why It’s Great for Beginners:

- Guaranteed returns

- Risk-free investment

- Completely tax-free interest

- Suitable for retirement corpus or long-term goals

How to Start:

You can open a PPF account through any major bank or India Post. It’s ideal to invest at the beginning of the financial year for maximum interest benefit.

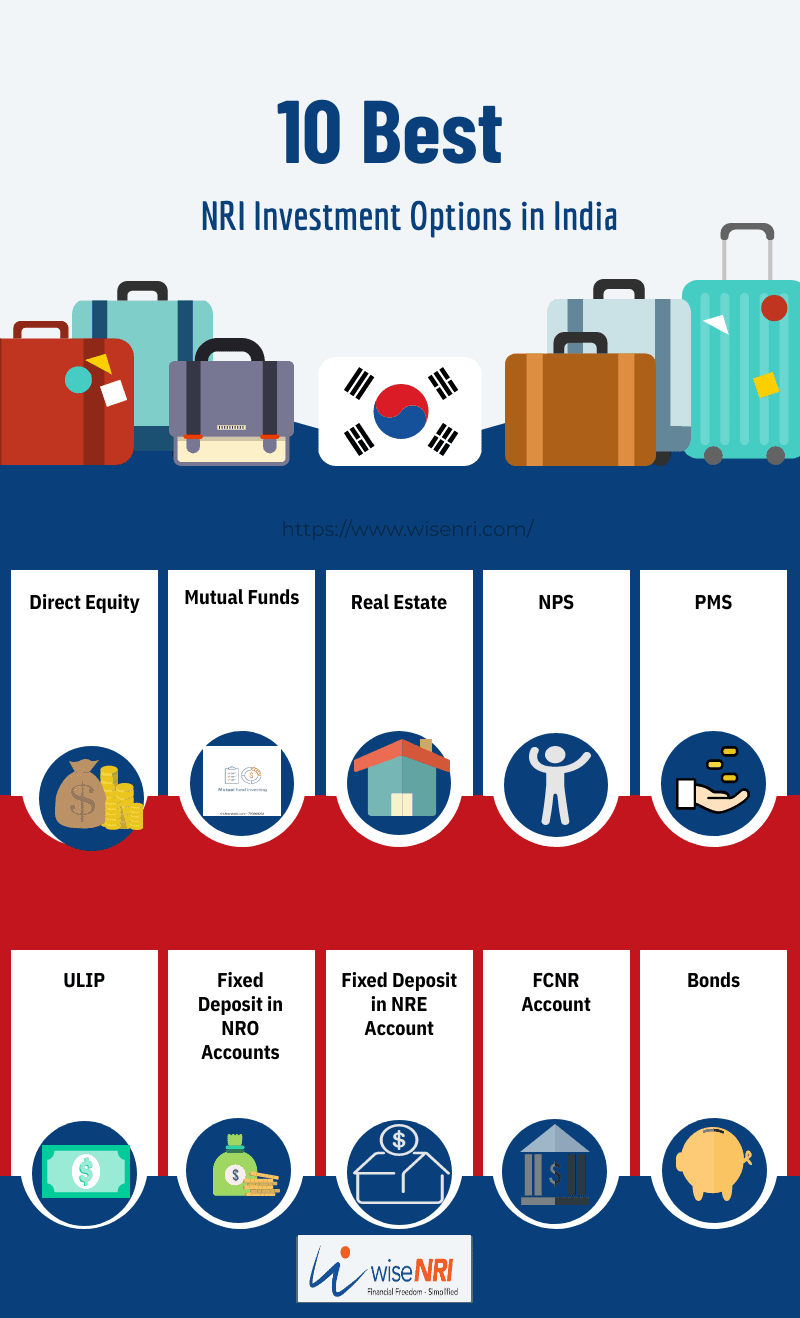

2. Systematic Investment Plans (SIPs) in Mutual Funds

A Systematic Investment Plan (SIP) allows you to invest a fixed amount every month into a mutual fund scheme—helping you harness the power of rupee-cost averaging and compounding.

Types of Mutual Funds Suitable for Beginners:

- Large-Cap Funds: Invest in top 100 companies (stable and less risky)

- ELSS (Equity Linked Savings Scheme): Offers tax benefits under Section 80C

- Hybrid Funds: Combine equity and debt for balanced growth

Key Benefits:

- Start with just ₹500/month

- Flexible and disciplined investment

- Professionally managed funds

- Long-term wealth generation

Best Platforms for SIPs in 2025:

- Zerodha Coin

- Groww

- ET Money

- Paytm Money

3. Fixed Deposits (FDs)

While FDs aren’t flashy, they remain a solid option for beginners, especially those with low risk tolerance.

Key Features:

- Returns: 6% to 7.5% p.a. (varies by bank and tenure)

- Tenure: 7 days to 10 years

- Safety: Backed by banks and regulated by RBI

- Taxation: Interest is taxable; TDS applies above ₹40,000/year

Why It’s Good for Beginners:

- Capital protection

- Predictable returns

- Useful for short-term goals or emergency corpus

- No market volatility

Pro Tip: Check FDs from small finance banks (like AU Small Finance Bank, Jana Bank) for slightly higher returns with RBI regulation.

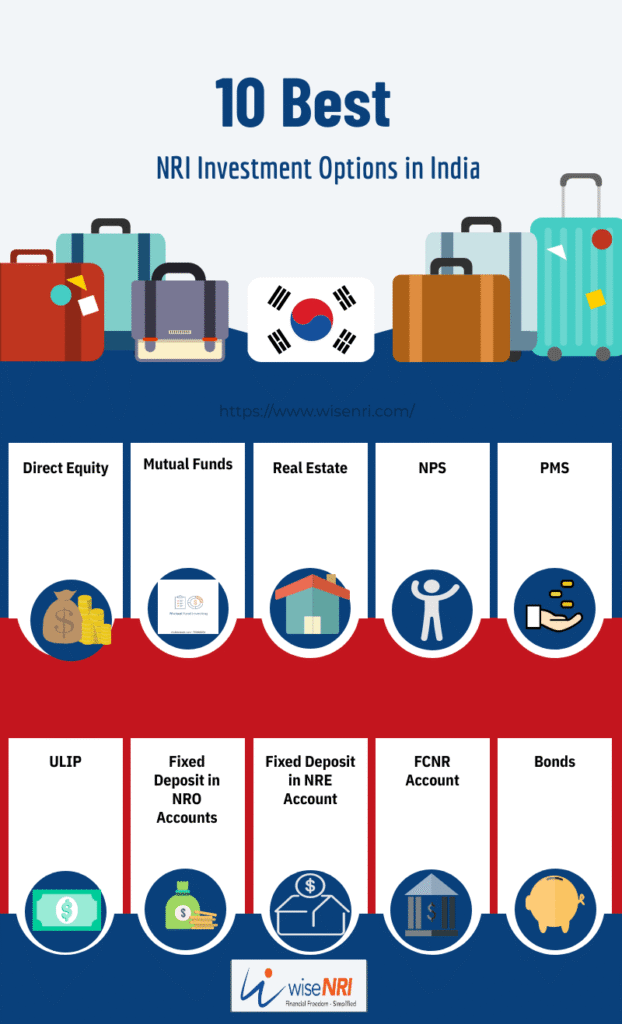

4. National Pension System (NPS)

The NPS is a retirement-focused investment regulated by the Pension Fund Regulatory and Development Authority (PFRDA). It’s a great choice for long-term retirement planning.

Key Benefits:

- Invests in equity, corporate bonds, and government securities

- Auto or active fund allocation

- Tax deduction under Section 80CCD (up to ₹50,000 extra beyond 80C)

- Partial withdrawal allowed after 3 years

Who Should Consider It?

- Salaried individuals

- Self-employed professionals

- Anyone planning long-term and looking for extra tax benefits

How to Start:

Register online through the NSDL website or via your bank. Choose between Tier I (pension-focused) and Tier II (optional savings).

5. Index Funds

If you want to invest in the stock market without picking individual stocks, index funds are the perfect solution.

What Are Index Funds?

These funds mirror a particular stock market index—like Nifty 50, Sensex, or Nifty Next 50.

Key Features:

- Low expense ratio (as low as 0.1%)

- No fund manager bias

- Ideal for passive investors

- Long-term capital growth

Top Performing Index Funds (2025):

- Nippon India Nifty 50 Index Fund

- UTI Nifty Next 50 Index Fund

- HDFC Index Sensex Fund

Note: Ideal for goals over 5 years and suitable for SIPs.

Tips for First-Time Investors in 2025

- Start Small, Stay Consistent: Invest ₹500–₹1,000 monthly. Let compounding work.

- Set Clear Goals: Emergency fund, education, house down payment, retirement

- Avoid FOMO: Stay away from crypto, stock tips, or speculative assets early on

- Monitor But Don’t Panic: Long-term investing requires patience, not daily tracking

- Stay Educated: Follow reliable financial blogs, YouTube channels, and books

Conclusion

Investing in 2025 doesn’t need to be complex. For beginners, the best strategy is to choose simple, low-risk, and diversified instruments like PPF, SIPs, FDs, NPS, and Index Funds. These options offer a great balance between safety, tax savings, and wealth creation.

Start small, remain consistent, and review your financial plan yearly. The earlier you begin, the easier it becomes to reach your goals.