In a world full of financial uncertainty, building an emergency fund is no longer optional—it’s essential. Whether you’re dealing with sudden medical bills, a job loss, or an unexpected car repair, having savings set aside can protect you from going into debt or making desperate decisions.

What Is an Emergency Fund?

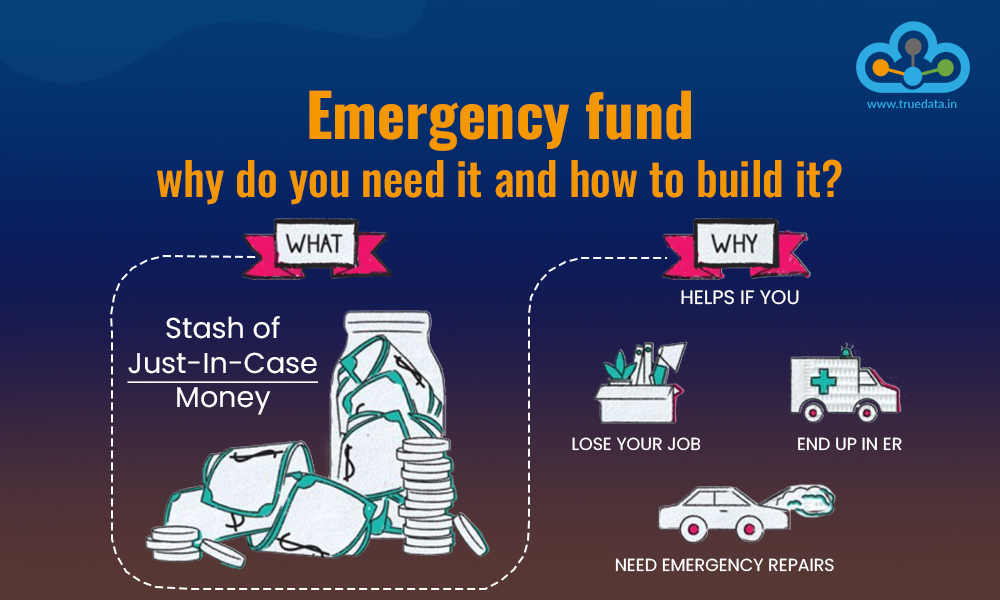

An emergency fund is a financial cushion designed to cover unexpected expenses. It’s typically 3–6 months’ worth of essential living costs, including rent, utilities, groceries, and transportation. The fund gives you time to recover from financial shocks without relying on high-interest debt like credit cards or personal loans.

Why It’s More Important Now Than Ever

The global economy in 2025 continues to be unpredictable. From inflation to interest rate hikes, and employment shifts due to automation and AI, people are more financially vulnerable than ever. An emergency fund can be the difference between stability and financial ruin during turbulent times.

How Much Should You Save?

Start with a goal that feels manageable. For most people, $1,000 is a great starter amount. From there, aim to save three months of essential expenses. If you’re a freelancer, contractor, or in a volatile job market, consider saving up to six months’ worth.

Where Should You Keep It?

Your emergency fund should be easily accessible but separate from your main account so you’re not tempted to dip into it. Good options include:

- High-yield savings accounts

- Money market accounts

- No-penalty CDs

Avoid keeping it in investment accounts, where the money could lose value in a market downturn just when you need it most.

Steps to Start Your Emergency Fund

- Set a Goal – Know how much you want to save and by when.

- Automate Savings – Set up auto-transfers from your paycheck or checking account to a dedicated savings account.

- Cut Unnecessary Spending – Redirect money from subscriptions or impulse buys.

- Use Windfalls Wisely – Allocate bonuses, tax refunds, or gifts toward your fund.

- Track Progress – Use a spreadsheet or an app to monitor your growth.

Common Mistakes to Avoid

- Using credit as an emergency fund – Credit cards carry high interest rates and can spiral into debt.

- Investing your emergency savings – Your goal is safety, not returns.

- Tapping into it for non-emergencies – A flash sale or vacation doesn’t count!

When Should You Use Your Emergency Fund?

Use it only for true emergencies:

- Job loss

- Medical emergencies

- Major car or home repairs

- Urgent travel due to family emergencies

After using the fund, make a plan to replenish it as soon as possible.

Final Thoughts

Think of your emergency fund as financial self-care. It gives you peace of mind and power—the power to make decisions based on logic, not panic. In today’s economy, where the unexpected has become the norm, building this financial buffer is one of the smartest moves you can make.

Take action today. Even saving Rs. 1000 a month can change your financial future.What Is an Emergency Fund?

An emergency fund is a financial cushion designed to cover unexpected expenses. It’s typically 3–6 months’ worth of essential living costs, including rent, utilities, groceries, and transportation. The fund gives you time to recover from financial shocks without relying on high-interest debt like credit cards or personal loans.

Why It’s More Important Now Than Ever

The global economy in 2025 continues to be unpredictable. From inflation to interest rate hikes, and employment shifts due to automation and AI, people are more financially vulnerable than ever. An emergency fund can be the difference between stability and financial ruin during turbulent times.

How Much Should You Save?

Start with a goal that feels manageable. For most people, $1,000 is a great starter amount. From there, aim to save three months of essential expenses. If you’re a freelancer, contractor, or in a volatile job market, consider saving up to six months’ worth.

Where Should You Keep It?

Your emergency fund should be easily accessible but separate from your main account so you’re not tempted to dip into it. Good options include:

- High-yield savings accounts

- Money market accounts

- No-penalty CDs

Avoid keeping it in investment accounts, where the money could lose value in a market downturn just when you need it most.

Steps to Start Your Emergency Fund

- Set a Goal – Know how much you want to save and by when.

- Automate Savings – Set up auto-transfers from your paycheck or checking account to a dedicated savings account.

- Cut Unnecessary Spending – Redirect money from subscriptions or impulse buys.

- Use Windfalls Wisely – Allocate bonuses, tax refunds, or gifts toward your fund.

- Track Progress – Use a spreadsheet or an app to monitor your growth.

Common Mistakes to Avoid

- Using credit as an emergency fund – Credit cards carry high interest rates and can spiral into debt.

- Investing your emergency savings – Your goal is safety, not returns.

- Tapping into it for non-emergencies – A flash sale or vacation doesn’t count!

When Should You Use Your Emergency Fund?

Use it only for true emergencies:

- Job loss

- Medical emergencies

- Major car or home repairs

- Urgent travel due to family emergencies

After using the fund, make a plan to replenish it as soon as possible.

Final Thoughts

Think of your emergency fund as financial self-care. It gives you peace of mind and power—the power to make decisions based on logic, not panic. In today’s economy, where the unexpected has become the norm, building this financial buffer is one of the smartest moves you can make.

Take action today. Even saving Rs. 1000 a month can change your financial future.